Data:

{'Open': {0: 159.18000000000001, 1: 157.99000000000001, 2: 157.66, 3: 157.53999999999999, 4: 155.03999999999999, 5: 155.47999999999999, 6: 155.44999999999999, 7: 155.93000000000001, 8: 155.0, 9: 157.72999999999999},

'Close': {0: 157.97999999999999, 1: 157.66, 2: 157.53999999999999, 3: 155.03999999999999, 4: 155.47999999999999, 5: 155.44999999999999, 6: 155.87, 7: 155.0, 8: 157.72999999999999, 9: 157.31}}

Code:

import pandas as pd

d = #... data above.

df = pd.DataFrame.from_dict(d)

df['Close_Stdev'] = pd.rolling_std(df[['Close']],window=5)

print df

# Close Open Close_Stdev

# 0 157.98 159.18 NaN

# 1 157.66 157.99 NaN

# 2 157.54 157.66 NaN

# 3 155.04 157.54 NaN

# 4 155.48 155.04 1.369452

# 5 155.45 155.48 1.259754

# 6 155.87 155.45 0.975464

# 7 155.00 155.93 0.358567

# 8 157.73 155.00 1.065190

# 9 157.31 157.73 1.189378

Problem:

The above code has no problems. However, is it possible for rolling_std to be able to factor in its window of observation the first four values in Close and the fifth value in Open? Basically, I want rolling_std to calculate the following for its first Stdev:

157.98 # From Close

157.66 # From Close

157.54 # From Close

155.04 # From Close

155.04 # Bzzt, from Open.

Technically, this means that the last value of the observed list is always the last Close value.

Logic/Reason:

Obviously, this is stock data. I'm trying to check if it's better to factor in the Open price of a stock for the current trading day in the calculation of standard deviation rather than stop at just checking the previous Closes.

Desired Result:

# Close Open Close_Stdev Desired_Stdev

# 0 157.98 159.18 NaN NaN

# 1 157.66 157.99 NaN NaN

# 2 157.54 157.66 NaN NaN

# 3 155.04 157.54 NaN NaN

# 4 155.48 155.04 1.369452 1.480311

# 5 155.45 155.48 1.259754 1.255149

# 6 155.87 155.45 0.975464 0.994017

# 7 155.00 155.93 0.358567 0.361151

# 8 157.73 155.00 1.065190 0.368035

# 9 157.31 157.73 1.189378 1.291464

Extra Details:

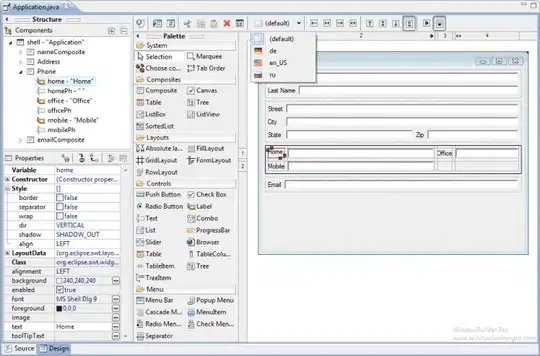

This can easily be done in Excel by using the formula STDEV.S and selecting the numbers as seen in the screenshot below. However, I want this done in Python and pandas for personal reasons (I'm highlighting F6, it's not just visible due to Snagit's effect).