I have essentially copied the code from the Matlab Example file BermudanSwaption.m in an effort to calibrate the Hull White one factor model to some given market data. As I use a subset about 30 or fewer swaptions for my calibration set, I am able to arrive at an interior solution. But when I use a larger set of instruments, I get a weird error:

Below is the code:

ValuationDate = '10-01-2014';

Settle = datenum(ValuationDate);

% Zero rate data is market data, bootstrapped from Bloomberg and Reuters quotes

CurveDates = [735874;

735882;

735906;

735936;

735950;

736040;

736133;

736224;

736314;

736424;

736606;

736788;

736971;

737153;

737336;

737518;

737701;

737884;

738069;

738251;

738433;

738615;

738797;

738979;

739162;

739345;

739528;

739710;

739893;

740075;

740260;

740442;

740624;

740806;

740989;

741171;

741354;

741536;

741719;

741901;

742084;

742269;

742451;

742633;

742815;

742997;

743180;

743362;

743545;

743728;

743911;

744093;

744278;

744460;

744642;

744824;

745006;

745189;

745372;

745554;

745737;

745919;

746102;

746284;

746469;

746651;

746833;

747015;

747198;

747380;

747563;

747745;

747928;

748111;

748296;

748478;

748660;

748842;

749024;

749206;

749389;

749572;

749755;

749937;

750120;

750302;

750487];

ZeroRates = 1.0e-03*[0.0172;

0.0188;

0.0191;

0.0221;

0.0249;

0.0244;

0.0269;

0.0333;

0.0423;

0.0571;

0.0789;

0.1021;

0.1253;

0.1435;

0.1617;

0.1749;

0.1881;

0.1973;

0.2064;

0.2158;

0.2253;

0.2311;

0.2370;

0.2429;

0.2488;

0.2547;

0.2607;

0.2640;

0.2672;

0.2706;

0.2738;

0.2772;

0.2807;

0.2842;

0.2877;

0.2913;

0.2948;

0.2964;

0.2979;

0.2995;

0.3011;

0.3026;

0.3043;

0.3060;

0.3077;

0.3095;

0.3112;

0.3118;

0.3125;

0.3132;

0.3138;

0.3146;

0.3152;

0.3160;

0.3167;

0.3175;

0.3183;

0.3186;

0.3189;

0.3192;

0.3196;

0.3199;

0.3202;

0.3206;

0.3209;

0.3213;

0.3217;

0.3217;

0.3216;

0.3216;

0.3216;

0.3216;

0.3216;

0.3216;

0.3216;

0.3216;

0.3216;

0.3217;

0.3217;

0.3218;

0.3218;

0.3219;

0.3219;

0.3220;

0.3220;

0.3221;

0.3221];

Compounding = 2;

RateSpec = intenvset('Compounding', 2,'ValuationDate', ValuationDate,'StartDates', ValuationDate,'EndDates', CurveDates,'Rates', ZeroRates);

InstrumentMaturity = datenum('12-Sep-2044');

% Swaption Vol data from Bloomberg

SwaptionBlackVol = [ 0.5940 0.5550 0.4450 0.3710 0.3400 0.3110 0.2910 0.2750 0.2630 0.2520 0.2250 0.2140 0.2080 0.2050;

0.5630 0.5470 0.4420 0.3690 0.3360 0.3090 0.2900 0.2740 0.2630 0.2520 0.2260 0.2150 0.2090 0.2060;

0.5760 0.5330 0.4400 0.3730 0.3410 0.3150 0.2970 0.2820 0.2700 0.2590 0.2330 0.2220 0.2170 0.2140;

0.5840 0.5020 0.4240 0.3730 0.3480 0.3240 0.3060 0.2920 0.2810 0.2710 0.2430 0.2300 0.2230 0.2190;

0.5630 0.4750 0.4100 0.3700 0.3450 0.3230 0.3070 0.2940 0.2830 0.2740 0.2470 0.2330 0.2260 0.2210;

0.5510 0.4520 0.3980 0.3660 0.3410 0.3220 0.3070 0.2950 0.2850 0.2760 0.2500 0.2360 0.2290 0.2240;

0.4630 0.4010 0.3660 0.3440 0.3250 0.3100 0.2990 0.2890 0.2790 0.2720 0.2470 0.2320 0.2260 0.2210;

0.4230 0.3750 0.3480 0.3290 0.3140 0.3030 0.2930 0.2840 0.2760 0.2690 0.2420 0.2300 0.2240 0.2190;

0.3700 0.3470 0.3280 0.3110 0.2960 0.2880 0.2800 0.2730 0.2680 0.2620 0.2360 0.2240 0.2190 0.2150;

0.3420 0.3250 0.3100 0.2970 0.2850 0.2770 0.2700 0.2640 0.2590 0.2540 0.2280 0.2180 0.2140 0.2110;

0.3230 0.3010 0.2900 0.2810 0.2720 0.2650 0.2590 0.2540 0.2500 0.2470 0.2230 0.2130 0.2090 0.2060;

0.3010 0.2860 0.2760 0.2670 0.2580 0.2530 0.2480 0.2450 0.2420 0.2390 0.2160 0.2060 0.2030 0.2000;

0.2850 0.2750 0.2650 0.2560 0.2480 0.2440 0.2400 0.2370 0.2350 0.2320 0.2100 0.2000 0.1970 0.1940;

0.2710 0.2600 0.2510 0.2440 0.2380 0.2340 0.2310 0.2290 0.2260 0.2240 0.2040 0.1940 0.1910 0.1890;

0.2580 0.2470 0.2400 0.2350 0.2300 0.2270 0.2240 0.2210 0.2190 0.2170 0.1980 0.1890 0.1860 0.1840;

0.2460 0.2370 0.2320 0.2270 0.2240 0.2210 0.2180 0.2150 0.2130 0.2110 0.1980 0.1840 0.1820 0.1800;

0.2040 0.1980 0.1950 0.1920 0.1900 0.1890 0.1890 0.1880 0.1880 0.1870 0.1720 0.1660 0.1640 0.1620;

0.1790 0.1750 0.1740 0.1730 0.1730 0.1710 0.1710 0.1700 0.1690 0.1690 0.1530 0.1510 0.1500 0.1480;

0.1650 0.1650 0.1660 0.1670 0.1680 0.1670 0.1670 0.1680 0.1680 0.1680 0.1550 0.1580 0.1560 0.1530;

0.1530 0.1570 0.1590 0.1620 0.1640 0.1650 0.1660 0.1670 0.1680 0.1690 0.1560 0.1650 0.1620 0.1590];

% The tenors for the underlying swaps and the options on them

SwaptionExerciseDates = cellstr(['1M ';'2M ';'3M '; '6M ';'9M ';'1Y ';'18M';'2Y ';'3Y ';'4Y ';'5Y ';'6Y ';'7Y ';'8Y ';'9Y ';'10Y';'15Y';'20Y';'25Y';'30Y']);

SwaptionTenors = cellstr(['1Y ';

'2Y ';

'3Y ';

'4Y ';

'5Y ';

'6Y ';

'7Y ';

'8Y ';

'9Y ';

'10Y';

'15Y';

'20Y';

'25Y';

'30Y']);

testmat = zeros(length(SwaptionExerciseDates),1);

% Here I construct a matrix of exercise dates

for i = 1:length(SwaptionExerciseDates)

if SwaptionExerciseDates{i}(end)=='Y'

testmat(i) = addtodate(Settle,str2double(SwaptionExerciseDates{i}(1:end-1)),'year');

elseif SwaptionExerciseDates{i}(end)=='M'

testmat(i)=addtodate(Settle,str2double(SwaptionExerciseDates{i}(1:end-1)),'month');

end

end

EurExDates= testmat;

EurExDatesFull = repmat(testmat,1,length(SwaptionTenors));

testmat2 = zeros(length(SwaptionExerciseDates),length(SwaptionTenors));

% Here I construct a matix of maturity dates

for i = 1:size(EurExDatesFull,1)

for j = 1:size(EurExDatesFull,2)

if SwaptionTenors{j}(end)=='Y'

testmat2(i,j) = addtodate(EurExDatesFull(i,j),str2double(SwaptionTenors{j}(1:end-1)),'year');

elseif SwaptionTenors{j}(end)=='M'

testmat2(i,j)= addtodate(EurExDatesFull(i,j),str2double(SwaptionTenors{j}(1:end-1)),'month');

end

end

end

EurMatFull = testmat2;

% I construct an index of all the swaptions that I intend to use for calibration

relidx = find(EurMatFull <= InstrumentMaturity);

SwaptionBlackPrices = zeros(size(SwaptionBlackVol));

SwaptionStrike = zeros(size(SwaptionBlackVol));

% back out the swaption strikes and prices from the implied vol data.

for iSwaption=1:length(SwaptionExerciseDates)

for iTenor=1:length(SwaptionTenors)

[~,SwaptionStrike(iSwaption,iTenor)] = swapbyzero(RateSpec,[NaN 0],Settle, EurMatFull(iSwaption,iTenor),...

'StartDate',EurExDatesFull(iSwaption,iTenor),'LegReset',[1 2],'Basis',2);

SwaptionBlackPrices(iSwaption,iTenor) = swaptionbyblk(RateSpec,'call', SwaptionStrike(iSwaption,iTenor),Settle, ...

EurExDatesFull(iSwaption,iTenor), EurMatFull(iSwaption,iTenor),SwaptionBlackVol(iSwaption,iTenor));

end

end

TimeSpec = hwtimespec(Settle,daysadd(Settle,30*(1:370),6), 12);

% construct an index of some random collection of instruments

B = (214:224);

HW1Fobjfun4 = @(x) SwaptionBlackPrices(relidx(B)) - ...

swaptionbyhw(hwtree(hwvolspec(ValuationDate,testmat,x(2),testmat,x(1),'spline'), RateSpec, TimeSpec), 'call',SwaptionStrike(relidx(B)),EurExDatesFull(relidx(B)), 0,EurExDatesFull(relidx(B)), EurMatFull(relidx(B)),'Basis',2, 'SwapReset',12);

options = optimset('disp','iter','MaxFunEvals',1000,'TolFun',1e-5);

x0 = [.1 .01];

lb = [0 0];

ub = [1 1];

HW1Fparams = lsqnonlin(HW1Fobjfun4,x0,lb,ub,options)

In the results, when I just use instruments numbered 214:224, I am able to find a local minima: HW1Fparams(1) = 0.0801 , HW1Fparams(2) = 0.0002

however when I use instruments say 150:224 I get the following error:

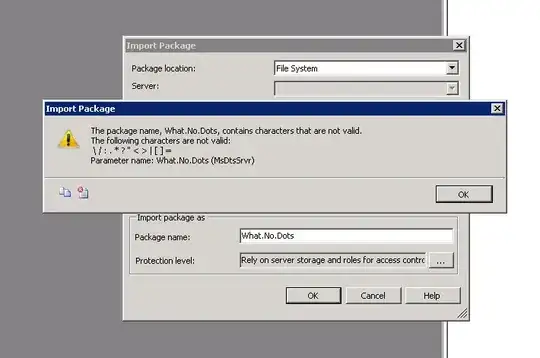

"subscript indices must be real positive integers or logicals" error in cummswapcfbytrintree (line 23)

This is a Matlab created file. Does anyone know what's going wrong here? How do I go about diagnosing/debugging in the error is in some Matlab created file. The usual techniques of checking which variable or which index is being given a zero or double value are not at my disposal anymore. Thanks.