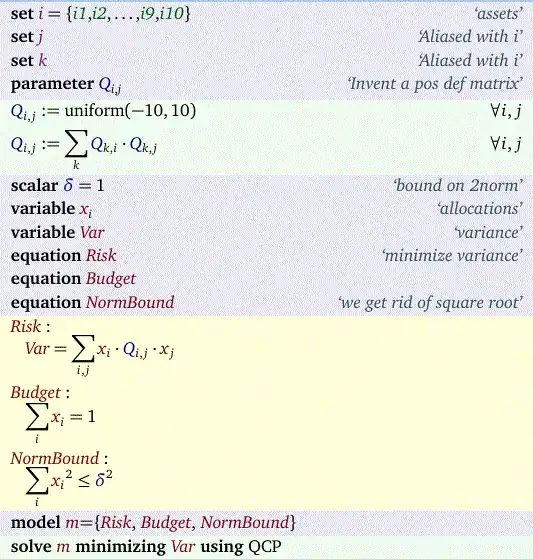

I am trying to solve the following inequality constraint:

Given time-series data for N stocks, I am trying to construct a portfolio weight vector to minimize the variance of the returns.

the objective function:

min w^{T}\sum w

s.t. e_{n}^{T}w=1

\left \| w \right \|\leq C

where w is the vector of weights, \sum is the covariance matrix, e_{n}^{T} is a vector of ones, C is a constant. Where the second constraint (\left \| w \right \|) is an inequality constraint (2-norm of the weights).

I tried using the nloptr() function but it gives me an error: Incorrect algorithm supplied. I'm not sure how to select the correct algorithm and I'm also not sure if this is the right method of solving this inequality constraint.

I am also open to using other functions as long as they solve this constraint.

Here is my attempted solution:

data <- replicate(4,rnorm(100))

N <- 4

fn<-function(x) {cov.Rt<-cov(data); return(as.numeric(t(x) %*%cov.Rt%*%x))}

eqn<-function(x){one.vec<-matrix(1,ncol=N,nrow=1); return(-1+as.numeric(one.vec%*%x))}

C <- 1.5

ineq<-function(x){

z1<- t(x) %*% x

return(as.numeric(z1-C))

}

uh <-rep(C^2,N)

lb<- rep(0,N)

x0 <- rep(1,N)

local_opts <- list("algorithm"="NLOPT_LN_AUGLAG,",xtol_rel=1.0e-7)

opts <- list("algorithm"="NLOPT_LN_AUGLAG,",

"xtol_rel"=1.0e-8,local_opts=local_opts)

sol1<-nloptr(x0,eval_f=fn,eval_g_eq=eqn, eval_g_ineq=ineq,ub=uh,lb=lb,opts=opts)