I would like to merge several xts objects into a single xts object. So that I can get a correlation matrix between the objects on close price.

The Code below pulls down the forex data

require(xts)

symbols <- c("AUDJPY", "AUDUSD", "CHFJPY", "EURCHF", "EURGBP", "EURJPY",

"EURUSD", "GBPCHF", "GBPJPY", "GBPUSD", "NZDUSD", "USDCAD",

"USDCHF", "USDJPY", "XAGUSD", "XAUUSD")

fxhistoricaldata <- function(Symbol, timeframe, download = FALSE, bandwidth) {

# setup temp folder

temp.folder <- tempdir()

filename <- paste(temp.folder, '/',"fxhistoricaldata_",Symbol ,"_" ,timeframe,".csv", sep='')

if(download) {

downloadfile <- paste("http://api.fxhistoricaldata.com/v1/indicators?instruments=" ,Symbol ,"&expression=open,high,low,close&item_count=10000&format=csv&timeframe=" ,timeframe,sep='')

download.file(downloadfile, filename, mode = 'wb')

}

tempdf <- read.csv(filename)

colnames(tempdf) <- c("Curr","Date","Open","High","Low","Close")

tempdf <- tempdf[c("Date","Open","High","Low","Close")]

result <- xts(tempdf[,-1], order.by=as.POSIXct(tempdf[,1]))

return(result)

}

AUDJPY <- fxhistoricaldata('AUDJPY' ,'day',download=T,5)

AUDUSD <- fxhistoricaldata('AUDUSD' ,'day',download=T,5)

CHFJPY <- fxhistoricaldata('CHFJPY' ,'day',download=T,5)

EURCHF <- fxhistoricaldata('EURCHF' ,'day',download=T,5)

EURGBP <- fxhistoricaldata('EURGBP' ,'day',download=T,5)

EURJPY <- fxhistoricaldata('EURJPY' ,'day',download=T,5)

EURUSD <- fxhistoricaldata('EURUSD' ,'day',download=T,5)

GBPCHF <- fxhistoricaldata('GBPCHF' ,'day',download=T,5)

GBPJPY <- fxhistoricaldata('GBPJPY' ,'day',download=T,5)

GBPUSD <- fxhistoricaldata('GBPUSD' ,'day',download=T,5)

NZDUSD <- fxhistoricaldata('NZDUSD' ,'day',download=T,5)

USDCAD <- fxhistoricaldata('USDCAD' ,'day',download=T,5)

USDCHF <- fxhistoricaldata('USDCHF' ,'day',download=T,5)

USDJPY <- fxhistoricaldata('USDJPY' ,'day',download=T,5)

XAGUSD <- fxhistoricaldata('XAGUSD' ,'day',download=T,5)

XAUUSD <- fxhistoricaldata('XAUUSD' ,'day',download=T,5)

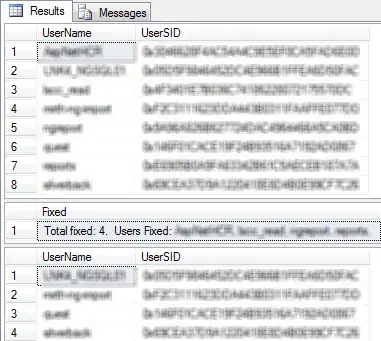

My desired results will look something like this with the close price below the symbol name but for all the symbol names

AUDJPY AUDUSD

2016-01-01 1.200 1.300

2016-01-02 1.21 1.31

Example of one of the xts objects