Looking to find every instance in which a time series of a stock index declines by 10% or greater. I am struggling to program it so that it understands order matters (don't want appreciation by 10%).

Ideally the code would: Pick value, check if value after it is 10% below, if not, check next, keep checking next until one is found then record that. Then, move to that "trough' or 'valley' as the beginning to continue the process of checking if values after it are 10% or more less than that value.

I have an Excel file with dates in the first column and the index value in the second

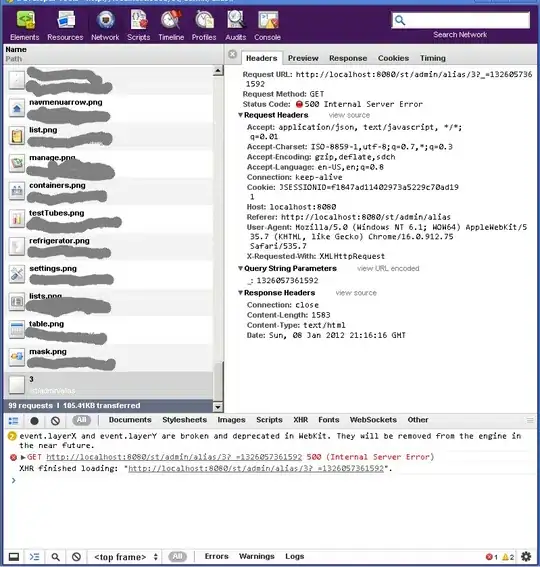

This is what it outputs which I don't think can be correct based on a graph

# Import Libraries

import pandas as pd

import numpy as np

import peakutils

from peakutils.plot import plot as pplot

from matplotlib import pyplot

import matplotlib.pyplot as plt

from scipy import signal

import csv

import scipy

import plotly.plotly as py

import plotly.graph_objs as go

from plotly.tools import FigureFactory as FF

# from pandas import DataFrame

# Import Excel as array

index = pd.read_csv(r"\Users\Reed_2\Desktop\Indexonly.csv")

print("as Pandas")

print (index.values)

# convert to 2 NumPy arrays

dates = index['Date'].as_matrix()

values = index['Index'].as_matrix()

print("values as NumPy")

print(values)

print("Date values")

print(dates)

# Find peaks

peaks = peakutils.indexes(values, thres=0.1, min_dist=1)

print ("peaks")

print(peaks)

a = np.asarray(peaks)

np.savetxt(r"C:\Users\Reed_2\Desktop\export.csv", a, delimiter=",")

Have access to Python, R Studio, and MatLab. Prefer Python as I know it best.

Very grateful for any help on this.