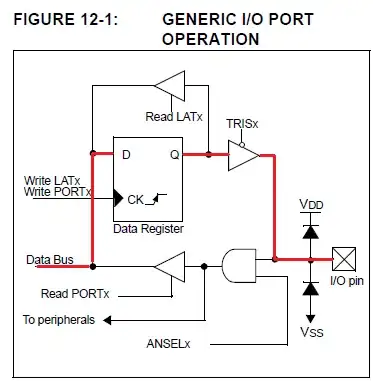

I would like to plot the development of different indexes with ggplot2. My problem is, that 2018-02-03 and 2018-02-04 are non-working days, and thus there is no data available for these days, but when plotting ggplot2 adds them by extrapolating. How could I omit the non-business days, so that I get 2018-02-02 followed by 2018-02-05?

library(tidyverse)

library(quantmod)

#retrieve data

getSymbols("BTCUSD=X;^DJI;^VIX;^GDAXI", from="2017-01-01")

#merge all dataframes together

df <- merge(`BTCUSD=X`,`DJI`, all = TRUE)

df <- merge(df, `VIX`, all = TRUE)

df <- merge(df, `GDAXI`, all = TRUE)

#creating a dataframe with first column as date that comes from xts object extracted by index()

df <- data.frame(date=index(df), coredata(df))

#selecting columns and filtering the time series start date

df_1 <- df%>% select(date, contains("Close"))%>% na.omit() %>% filter(date>"2018-01-25")

#df_1 <- df_1 %>%mutate(BTCUSD.X.Close=BTCUSD.X.Close/BTCUSD.X.Close[1], DJI.Close=DJI.Close/DJI.Close[1], GDAXI.Close=GDAXI.Close/GDAXI.Close[1], VIX.Close=VIX.Close/VIX.Close[1])

df_1 <- df_1 %>% gather(var, closing, 2:5)

png("indexes.png", width = 9, height = 6, units = 'in', res = 600)

plot_1 <- ggplot(data=df_1)+

geom_line(aes(x=date, y=closing))+

facet_wrap(~var, scales = "free")+

scale_x_date(breaks = df_1$date, date_minor_breaks = "1 day", date_labels = "%y-%m-%d")+

theme(text = element_text(size=7), axis.text.x = element_text(angle = 90, hjust = 1))

plot_1

dev.off()

plot_1