I'm looking for a way to generalize regression using pykalman from 1 to N regressors. We will not bother about online regression initially - I just want a toy example to set up the Kalman filter for 2 regressors instead of 1, i.e. Y = c1 * x1 + c2 * x2 + const.

For the single regressor case, the following code works. My question is how to change the filter setup so it works for two regressors:

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

from pykalman import KalmanFilter

if __name__ == "__main__":

file_name = '<path>\KalmanExample.txt'

df = pd.read_csv(file_name, index_col = 0)

prices = df[['ETF', 'ASSET_1']] #, 'ASSET_2']]

delta = 1e-5

trans_cov = delta / (1 - delta) * np.eye(2)

obs_mat = np.vstack( [prices['ETF'],

np.ones(prices['ETF'].shape)]).T[:, np.newaxis]

kf = KalmanFilter(

n_dim_obs=1,

n_dim_state=2,

initial_state_mean=np.zeros(2),

initial_state_covariance=np.ones((2, 2)),

transition_matrices=np.eye(2),

observation_matrices=obs_mat,

observation_covariance=1.0,

transition_covariance=trans_cov

)

state_means, state_covs = kf.filter(prices['ASSET_1'].values)

# Draw slope and intercept...

pd.DataFrame(

dict(

slope=state_means[:, 0],

intercept=state_means[:, 1]

), index=prices.index

).plot(subplots=True)

plt.show()

The example file KalmanExample.txt contains the following data:

Date,ETF,ASSET_1,ASSET_2

2007-01-02,176.5,136.5,141.0

2007-01-03,169.5,115.5,143.25

2007-01-04,160.5,111.75,143.5

2007-01-05,160.5,112.25,143.25

2007-01-08,161.0,112.0,142.5

2007-01-09,155.5,110.5,141.25

2007-01-10,156.5,112.75,141.25

2007-01-11,162.0,118.5,142.75

2007-01-12,161.5,117.0,142.5

2007-01-15,160.0,118.75,146.75

2007-01-16,156.5,119.5,146.75

2007-01-17,155.0,120.5,145.75

2007-01-18,154.5,124.5,144.0

2007-01-19,155.5,126.0,142.75

2007-01-22,157.5,124.5,142.5

2007-01-23,161.5,124.25,141.75

2007-01-24,164.5,125.25,142.75

2007-01-25,164.0,126.5,143.0

2007-01-26,161.5,128.5,143.0

2007-01-29,161.5,128.5,140.0

2007-01-30,161.5,129.75,139.25

2007-01-31,161.5,131.5,137.5

2007-02-01,164.0,130.0,137.0

2007-02-02,156.5,132.0,128.75

2007-02-05,156.0,131.5,132.0

2007-02-06,159.0,131.25,130.25

2007-02-07,159.5,136.25,131.5

2007-02-08,153.5,136.0,129.5

2007-02-09,154.5,138.75,128.5

2007-02-12,151.0,136.75,126.0

2007-02-13,151.5,139.5,126.75

2007-02-14,155.0,169.0,129.75

2007-02-15,153.0,169.5,129.75

2007-02-16,149.75,166.5,128.0

2007-02-19,150.0,168.5,130.0

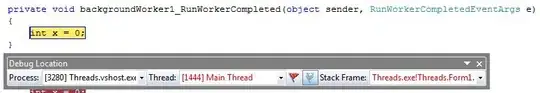

The single regressor case provides the following output and for the two-regressor case I want a second "slope"-plot representing C2.