This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 22 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 30,089 times.

Filing for bankruptcy is the process of requesting that a legal court releases you from your obligations to your creditors.[1] Individuals or married couples will typically file for either Chapter 7, Chapter 11, or Chapter 13 bankruptcy. The most common reasons for declaring bankruptcy involve costly personal problems like losing a job, going through a divorce, or coping with a serious illness/injury.[2] There is nothing shameful or irresponsible about having to declare bankruptcy, though it can have lasting implications on your credit. There are also a number of options available that may be able to help you avoid declaring bankruptcy. Learning how to evaluate your options and declare yourself bankrupt may help relieve some of your financial obligations, depending on the nature of your debts.

Steps

Evaluating Your Options

-

1Consider hiring an attorney. If your debt is forcing you to file for bankruptcy, you may not be thinking about hiring a lawyer. However, bankruptcy laws are very complex, and any error or misinterpretation of the law on your part could affect your rights in bankruptcy court.[3] You can find bankruptcy lawyers in your area by searching online, in the phone book, or by using the American Bar Association's "Find Legal Help" website.[4] A lawyer will be able to:

- explain bankruptcy law and all of the relevant court proceedings to you

- determine whether or not your debts are eligible for discharge

- provide you with advice on whether to file a bankruptcy petition

- advise you on which chapter to file under

- assist you in completing and filing forms

- help you plan out whether or not you will be able to keep your personal property (including your home and your automobile)

- inform you of any tax consequences that may result from filing

- advise you on whether or not you should continue paying your creditors during proceedings

-

2Distinguish between types of debt. Bankruptcy is a sound legal option if you absolutely cannot escape your debt. However, not all debts are covered by bankruptcy laws, and some debt may remain with you even if you successfully file for bankruptcy.[5]

- Private, unsecured debts are eligible for bankruptcy protection. This category of debt includes credit card bills, medical bills, utility costs, and personal loans.

- Secured debts are not eligible for bankruptcy protection. This category includes debt that accrues for child support payments, taxes, and student loans.

Advertisement -

3Determine if you're eligible for discharge. Bankruptcy laws may vary from state to state and from one country to another. In the United States, there are limits to how often an individual or a married couple can file for bankruptcy. This is to prevent the deliberate misuse of money and to ensure that those who are actually burdened with financial problems can find ways to escape their debt.

- You are ineligible to receive a discharge (meaning your debts are forgiven) under Chapter 7 bankruptcy if you were given a Chapter 7 discharge in the last eight years or a Chapter 13 discharge in the last six years, though there may be some exceptions.

- You are ineligible to receive a discharge under Chapter 13 bankruptcy if you were given a Chapter 7 discharge in the last four years or a Chapter 13 discharge in the last two years.

- There is no mandatory waiting period for Chapter 11 bankruptcy.

- If you filed for bankruptcy in any form but were not given a discharge, these time limits will not apply to your current case, and you should be free to proceed.[6]

-

4Understand the types of bankruptcy. The three most common types of bankruptcy an individual or married couple will file for are Chapter 7, Chapter 11, and Chapter 13. Before you can file for bankruptcy, you'll need to decide which chapter you'll file, as each chapter has its own forms and proceedings.

- Chapter 7 requires you to liquidate all of your assets. This can entail repossession of your property for sale at a public auction. In order to qualify for Chapter 7, you must pass an income test for the court. You will have to pay a filing fee of $306 to the court (this may vary by county or state), but this fee may be paid in installments or waived altogether.

- Chapter 11 involves a court-ordered reorganization of your debts and assets. There are no income requirements for Chapter 11. You will have to pay a filing fee of $1,046 to the court (this may vary), which can be paid in installments for up to 90 days.

- Chapter 13 results in a debt adjustment. You must have a regular, steady income to qualify for Chapter 13, and you must have less than $1,081,400 in secured debt and $360,475 in unsecured debt. You will have to pay a filing fee of $281 to the court (again, this may vary), which can be paid in installments for up to 45 days.[7]

Beginning Your Bankruptcy Proceedings

-

1Attend credit counseling. Under current U.S. laws, anyone seeking to file a petition for bankruptcy must attend credit counseling through a U.S. Trustee Program before being able to proceed.[8] To find a credit counseling agency in your area, go to the U.S. Justice Department's website and search for List of Credit Counseling Agencies Approved Pursuant to 11 U.S.C. § 111. You can then use the drop-down menu to choose which language you would like your credit counseling agency to be fluent in. This will give you a comprehensive listing of credit counseling agencies by state, along with relevant contact information.[9]

- The U.S. Justice Department's Trustee Program does not operate in the states of Alabama or North Carolina. In those states, you must take a course that has been approved by a court-appointed Bankruptcy Administrator.[10] You can find a listing of approved counselors in Alabama and North Carolina by visiting the U.S. Courts website.[11]

- A typical credit counseling session will last approximately 60 to 90 minutes, and may be conducted either in person, over the phone, or online.

- Credit counseling typically costs around $50, though this will vary by county and state. If you cannot afford to pay this fee, you must ask for a fee waiver from the counseling agency before you begin your credit counseling session.

- Upon completion of credit counseling, you will receive a certificate that confirms your attendance and successful completion. You must file a copy of your certificate with the court before you can begin to file for bankruptcy.

-

2File Form B101. Once you've completed the required credit counseling, you may complete and file Form B101, the Voluntary Petition for Individuals Filing for Bankruptcy. This form is for individual debtors (including married couples), and can be found on the U.S. Courts' website under Bankruptcy Forms. It must be complete and as accurate as possible.[12]

- If you run out of room and need more space, you may attach a separate sheet to the form. Write your name and your case number (if you already have one) at the tops of any additional pages you attach, and identify both the form and the relevant line number for any information on the separate sheet(s).

- If a debt was incurred over multiple dates, you may fill in the range of dates (for example, for credit card debt, you may fill in that the first transaction occurred on January 2013 and the last transaction occurred on February 2014). If the debt was incurred on a single date, fill in that date.

- If you are working with an attorney or a law firm, the presiding attorney will need to sign and date the petition and include her name, address, and phone number in the relevant sections. If you are not working with an attorney, you must leave the attorney sections blank.

-

3Complete and submit Form 121. In addition to Form B101, you will need to complete and file Form 121, the Statement About Your Social Security Numbers. This form provides the court with your Social Security Number or federal Individual Taxpayer ID number. The courts will protect your full number from the general public, but your number will be provided in full to your creditors, the U.S. trustee or bankruptcy administrator, and the particular trustee who is assigned to your bankruptcy case. You can find this form online by visiting the U.S. Courts website under Bankruptcy Forms.[13]

-

4Provide additional information. Once you've completed Forms B101 and 121, you may need to provide additional information to the courts in order to begin your bankruptcy proceedings. All additional forms may be found on the U.S. Courts website under Bankruptcy Forms, and must be submitted to the court either at the time of filing or within 14 days of filing for bankruptcy. You may have to submit:

- a list containing the names and addresses of all of your creditors

- a copy of your credit counseling certificate

- Form 106 (Schedules of Assets and Liabilities)

- Form 107 (Statement of Financial Affairs for Individuals Filing for Bankruptcy)

- Director's Form 2030

- copies of all pay stubs or other evidence of payment received within 60 days before the date you file for bankruptcy

- Form 104 (only if you are filing under Chapter 11)

- Forms 101A and 101B (if your landlord has an eviction judgment against you and you want to remain in your rented residence for longer than 30 days after filing for bankruptcy)

- Form 119 (the Bankruptcy Petition Preparer's Notice, Declaration, and Signature) and Form 2800 (the Disclosure of Compensation of Bankruptcy Petition Preparer) - these must only be submitted if a bankruptcy petition preparer has assisted you in completing your forms.[14]

Filing for Specific Chapters of Bankruptcy

-

1Complete requirements for Chapter 7. In addition to all of the general requirements that you must complete before filing, there are some additional forms that are specific to Chapter 7 bankruptcy. Chapter 7 bankruptcy typically involves the liquidation of your personal assets to pay back your creditors. All forms for Chapter 7 bankruptcy proceedings can be found on the U.S. Courts' website under Bankruptcy Forms.[15]

- Form 108, the Statement of Intention for Individuals Filing Under Chapter 7, must be completed if creditors have any claims secured by your property or if you have leased personal property with an existing lease. You must submit this form within 30 days of filing for bankruptcy or by the date that has been set for the meeting of creditors (whichever is earlier).[16]

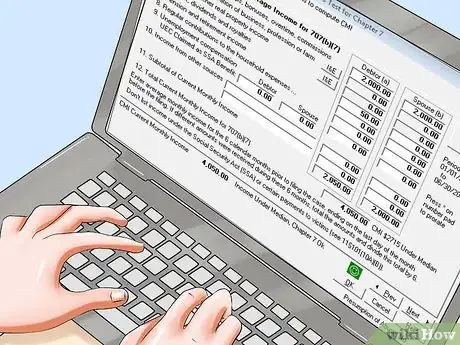

- Form 122A-1, the Statement of Your Current Monthly Income, must be completed and filed by anyone declaring Chapter 7 bankruptcy. The only exemptions are if your debt is not primarily consumer debts or if you have qualifying military service, in which case you must complete and file Form 122A-1Supp (the Statement of Exemption from Presumption of Abuse Under § 707(b)(2) form) along with your Form 122A-1.[17]

- You will need to pay a filing fee of $306 to the court, though this total may differ depending on your location. Depending on your financial situation, that fee may be waived or paid in installments for up to 90 days after filing.[18]

-

2Fulfill requirements for Chapter 11. Chapter 11 bankruptcy has additional requirements and forms which must be completed. In Chapter 11, your debts and assets are reorganized by the court, but there are no minimum income requirements. All additional forms for Chapter 11 can be found on the U.S. Courts' website under Bankruptcy Forms.[19]

- Form 104, The List of Creditors Who Have the 20 Largest Unsecured Claims Against You Who Are Not Insiders, must be completed by all individuals filing under Chapter 11. You must not include any claims by anyone who is determined to be an "insider," which includes your relatives, general partners/partnerships, corporations in which you are an officer/director/person in control/owner of 20% or more of voting securities, and any managing agents.[20]

- Form 122-B, the Statement of Your Current Monthly Income, must be completed by all individuals filing under Chapter 11. If any additional space is needed, you may attach a separate sheet to the form, provided you include the line number that each addition refers to.[21]

- You will need to pay a filing fee of $1,046 to the court, though this total may differ depending on your location. That fee may be paid in installments for up to 90 days.[22]

-

3Complete the requirements for Chapter 13. Chapter 13 has its own additional forms and requirements that must be completed in order to proceed. In Chapter 13 bankruptcy your debts are adjusted, provided you meet the specific income requirements. All additional forms for Chapter 13 can be found on the U.S. Courts' website under Bankruptcy Forms.[23]

- Form 122C-1, the Statement of Your Current Monthly Income and Calculation of Commitment Period, must be completed by all individuals filing under Chapter 13. This form assesses your financial status, factoring your gross wages/salary/tips/bonuses and other sources of income against any significant financial expenses, including alimony and child support.[24]

- Form 122C-2, the Calculation of Your Disposable Income, is used in conjunction with Form 122C-1. The purpose of Form 122C-2 is to calculate your deductions from your income to gain a more complete picture of your financial status. Form 122C-2 will require you to provide the court with a comprehensive summary of expenses you incur for food, clothing, out-of-pocket health care, monthly mortgage or rent payments, utilities and insurance, and transportation expenses.[25]

- Form 113, the Chapter 13 Plan, may be required depending on where you attend bankruptcy court. Some municipalities may require you to use a local form plan instead of Form 113. Check with your local court (either online or in person) to determine which form you will need to use to complete Chapter 13 bankruptcy.[26]

- You will need to pay a filing fee of $281 to the court, though this total may differ depending on your location. That fee may be paid in installments for up to 45 days after filing.[27]

-

4Attend a post-filing debtor education course. In addition to the pre-bankruptcy credit counseling session, anyone filing for bankruptcy in any chapter must also complete a post-filing debtor education course. This session will cover fiscal responsibility topics, including developing a budget, managing your money, and using credit with caution.[28] You can find court-approved course offerings in your area by searching the U.S. Department of Justice website for their listing of approved providers.[29]

- The course will typically last approximately two hours. It may be attended in person, on the telephone, or online.

- The fee for this course is generally between $50 to $100, depending on where you take the course. If you cannot afford the session fee, you may be able to have the fee waived. However, just like the ore-bankruptcy counseling session, you must ask for the fee to be waived before you attend the course.

- You will receive a certificate upon successful completion of the course. You should retain this certificate for your records so that you can verify your attendance in and completion of the course.

-

5Await a ruling. Once you have paid all court fees and met all of the requirements, including completion of all necessary forms and attendance in counseling/courses in bankruptcy and financial management, you will await a decision. If the court decides to dismiss your debt, you will receive a discharge. The duration of time before you receive a discharge ruling will vary, depending on which chapter of bankruptcy you file for.[30]

- In a Chapter 7 bankruptcy case, the court must wait for any objection to discharge complaints and any motion to dismiss the case for substantial abuse requests to be filed before granting a discharge. If no complaints are filed within 60 days after the first date set for the 341 meeting (the in-court meeting of creditors), a judge will grant a discharge if she finds no cause for dismissal. This usually occurs approximately four months after the initial bankruptcy petition was filed.

- In a Chapter 11 or Chapter 13 bankruptcy case, the court will typically grant a discharge as soon as it is feasible to do so, upon completion of all payments structured under the plan. These payments are typically made over the course of three to five years, with an average discharge date of approximately four years after the initial bankruptcy petition was filed.

- If you fail to complete the mandatory post-filing financial management course, the judge may deny a discharge and dismiss your case. Certain limited exceptions are made if you are disabled, incapacitated, or on active military duty in a combat zone.

- If you are granted a discharge, keep the discharge order for your records. If you should accidentally lose the discharge order, you can request a copy through the clerk of the bankruptcy court where your order was issued.

Warnings

- Be aware of the mental and emotional stress that can come with filing for bankruptcy. You will need to take care of your mental and physical health, perhaps more at this time than in normal circumstances. Speak with a therapist if you find yourself stressed, anxious, or emotionally unstable.⧼thumbs_response⧽

- Your credit rating will not be the same as it was before bankruptcy. However, having a discharge will not hurt your credit, and may make it easier to slowly rebuild your credit. This will take time, though, and you may have difficulty financing a house or car for a considerable amount of time after declaring bankruptcy.⧼thumbs_response⧽

- Make sure you provide all of the requested information to the court. Hiding a creditor, hiding assets, or withholding any other information will bring more legal problems, including fines and possibly incarceration.⧼thumbs_response⧽

Things You'll Need

- Attorney

- Bank statements

- Past-due bills

References

- ↑ http://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/discharge-bankruptcy-bankruptcy-basics

- ↑ http://money.usnews.com/money/personal-finance/articles/2012/05/14/5-bankruptcy-myths-debunked

- ↑ http://www.uscourts.gov/services-forms/bankruptcy/filing-without-attorney

- ↑ https://www.americanbar.org/groups/legal_services/flh-home/

- ↑ http://ctlawhelp.org/should-you-declare-bankruptcy#

- ↑ http://hemphill-attorney.com/repeat-bankruptcy-filings-can-i-file-bankruptcy-again/

- ↑ http://hemphill-attorney.com/bankruptcy-eligibility-can-i-file-bankruptcy/

- ↑ http://money.usnews.com/money/personal-finance/articles/2012/07/26/are-you-too-broke-to-go-bankrupt

- ↑ http://www.justice.gov/ust/list-credit-counseling-agencies-approved-pursuant-11-usc-111

- ↑ http://www.consumer.ftc.gov/articles/0224-filing-bankruptcy-what-know

- ↑ http://www.uscourts.gov/FederalCourts/Bankruptcy/BankruptcyResources/ApprovedCreditAndDebtCounselors.aspx

- ↑ http://www.uscourts.gov/forms/individual-debtors/voluntary-petition-individuals-filing-bankruptcy

- ↑ http://www.uscourts.gov/forms/bankruptcy-forms/your-statement-about-your-social-security-numbers

- ↑ http://www.uscourts.gov/forms/bankruptcy-forms

- ↑ http://www.uscourts.gov/forms/bankruptcy-forms

- ↑ http://www.uscourts.gov/forms/individual-debtors/statement-intention-individuals-filing-under-chapter-7

- ↑ http://www.uscourts.gov/forms/means-test-forms/chapter-7-statement-your-current-monthly-income

- ↑ http://hemphill-attorney.com/bankruptcy-eligibility-can-i-file-bankruptcy/

- ↑ http://www.uscourts.gov/forms/bankruptcy-forms

- ↑ http://www.uscourts.gov/forms/individual-debtors/individual-chapter-11-cases-list-creditors-who-have-20-largest-unsecured

- ↑ http://www.uscourts.gov/forms/means-test-forms/chapter-11-statement-your-current-monthly-income

- ↑ http://hemphill-attorney.com/bankruptcy-eligibility-can-i-file-bankruptcy/

- ↑ http://www.uscourts.gov/forms/bankruptcy-forms

- ↑ http://www.uscourts.gov/forms/means-test-forms/chapter-13-statement-your-current-monthly-income-and-calculation-commitment

- ↑ http://www.uscourts.gov/forms/means-test-forms/chapter-13-calculation-your-disposable-income

- ↑ http://www.uscourts.gov/courtlinks

- ↑ http://hemphill-attorney.com/bankruptcy-eligibility-can-i-file-bankruptcy/

- ↑ http://www.consumer.ftc.gov/articles/0224-filing-bankruptcy-what-know

- ↑ http://www.justice.gov/ust/list-approved-providers-personal-financial-management-instructional-courses-debtor-education

- ↑ http://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/discharge-bankruptcy-bankruptcy-basics

- ↑ http://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/discharge-bankruptcy-bankruptcy-basics