This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 38,564 times.

Money laundering occurs when individuals engage in questionable financial transactions in an attempt to hide or disguise funds from illegal activities. Most countries have laws that require banks and other financial service institutions to report money laundering and other suspicious transactions to the government. In the United States, employees at financial institutions are required to file a Suspicious Activity Report (SAR) with the Financial Crimes Enforcement Network (FinCEN). Even if you don't work at a bank or other financial institution, you can report suspected money laundering to local law enforcement or to the financial institution itself.[1]

Steps

Filing a Suspicious Activity Report

-

1Review your employer's policies. All financial institutions are required to have policies and procedures in place to allow employees to identify and report money laundering and other suspicious financial transactions.

- Your employee handbook or similar manual will include details about the procedure you should follow. For example, you may be required to report to a specific managerial employee who is in charge of filing SAR forms.

-

2Collect information about the customer and the transaction. You aren't required to provide information to FinCEN about the customer beyond the information available in the records for that customer's banking or investment account.[2]

- You'll need basic information about the customer, any other parties to the transaction, the amount of the transaction, and the date and time of the transaction.

- Generally, the transaction must involve at least $5,000 and appear to have no business, investment, or other lawful purpose other than to hide or disguise funds from illegal activities.

Advertisement -

3Access the BSA E-Filing system. All financial institutions must use FinCEN's electronic filing system to submit reports of suspicious activity. Your employer will have an e-filing account to access this system.[3]

- E-filing account access may be limited to specific bank managers. You may have to complete a paper form for the manager to enter. You'll find details about your employer's procedures in your employee handbook, or you can ask your supervisor.

-

4Complete the SAR form. The SAR form requires you to enter specific records with information regarding the transaction, including the financial institution and branch where the activity occurred, the amount of the transaction, and the type of commodity involved.[4]

- You also must provide information about the customer and any other parties involved, including account numbers and addresses or other identification information associated with the account.

-

5Submit the form to FinCEN. You file SAR forms through the BSA E-Filing system, either individually or in bulk. Financial institutions are required to submit a SAR within 30 days of the date the suspicious transaction occurred.[5]

- If you have any supporting documentation or business records related to the SAR, you must keep them for 5 years from the date you file the SAR, together with the financial institution's copy of the SAR.

- Regulatory authorities and law enforcement will review the SAR, and may contact you or your employer for additional information on the transaction or the customer involved.

Reporting to Law Enforcement

-

1Get as much information as you safely can. To report money laundering to local law enforcement, you need to be able to describe the activity in detail. However, you shouldn't try to get more information if doing so would put you at risk.[6]

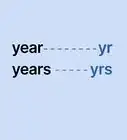

- Write down any names or addresses you know, as well as physical descriptions of any individuals you saw who you believe are involved in money laundering.

- If you have any additional information, such as where the people went after the transaction took place, you should include that as well.

-

2Contact your local police department. In most cases, you can file your report by calling the police non-emergency phone number, or by going to the police station in person during regular business hours.[7]

- If you believe there is a life-threatening emergency, don't hesitate to call 911. Even though money laundering itself is a nonviolent crime, there may be violent people involved.

- You can report suspicious activity to local law enforcement anonymously, but you may want to give them your name and contact information if you think you could be of further assistance.

- When you talk to an officer, tell them that you want to report suspected money laundering, and provide them with the information you have. Include as many details as you know, but stick to the facts.

-

3State specifically if you believe the activity is terrorist-related. Local police investigating terrorist-related incidents may be able to access additional funding and support from the federal government.[8]

- In the context of money laundering, terrorist-related suspicious activity might include someone with a relatively low-paying job who is moving large amounts of cash. Be especially wary if the money is moving to or from known havens for terrorist financing, or organizations known to support terrorism.[9]

- Don't claim the activity is terrorist-related if you have no reason to suspect this is true. For example, an activity isn't necessarily related to terrorism just because the people involved are Muslim.

-

4File complaints with federal regulatory agencies to report financial institutions. Federal regulatory agencies may take action to investigate reports of unethical or suspected criminal activity that involves a financial institution or its employees.[10]

- Your state securities regulator or the federal Securities and Exchange Commission (SEC) investigates investment fraud and other violations of securities law.

- The Consumer Finance Protection Bureau (CFPB) investigates criminal and fraudulent activities involving banks and lenders.

- The Federal Reserve System has an online financial institution search tool that can point you to the specific agency that regulates the financial institution you want to report. Go to https://www.ffiec.gov/consumercenter/default.aspx to access this tool.

Reporting to a Financial Institution

-

1Organize your information for the incident you want to report. If you witness suspicious activity or unethical behavior on the part of someone who works at a financial institution, you may be able to report that activity to the financial institution itself. Make notes about the transaction or incident you want to report.

- Notes can help you remember details and ensure you don't forget anything, especially if you're making your report over the phone.

-

2Search online for a form. Many financial institutions have an online form that you can complete if you want to report illegal or suspicious activity involving their employees. Online forms give you additional anonymity.[11]

- Being able to submit your report in writing also gives you a chance to look everything over and make sure you've included all the information you have.

-

3Contact the financial institution to report over the phone. Most financial institutions have a dedicated ethics or fraud hotline that you can use to report suspicious or illegal activity involving their employees.[12]

- You typically can find this number on the financial institution's website. If you can't find it, call the regular customer service number and explain to an operator that you want to report suspicious or illegal activity. If they can't take your report, they'll direct your call to the right place.

-

4Provide detailed information about the incident. Your report should include as many details as possible about the incident you observed and the reasons you suspect money laundering or other suspicious activity.[13]

- Include the date and time of the incident that gave rise to your suspicions, and include the names of any employees involved.

- A physical description of the customers involved can also help the financial institution identify the individuals involved so they can thoroughly investigate the situation and take appropriate action.

References

- ↑ https://www.law.cornell.edu/cfr/text/12/21.11

- ↑ https://www.fincen.gov/resources/statutes-regulations/guidance/frequently-asked-questions-suspicious-activity-reporting

- ↑ https://www.occ.treas.gov/tools-forms/forms/bank-operations/suspicious-activity-report-program.html

- ↑ https://bsaefiling.fincen.treas.gov/docs/FinCENSARElectronicFilingRequirements.pdf

- ↑ https://bsaefiling.fincen.treas.gov/docs/FinCENSARElectronicFilingRequirements.pdf

- ↑ https://www.dhs.gov/how-do-i/report-suspicious-activity

- ↑ https://www.dhs.gov/how-do-i/report-suspicious-activity

- ↑ https://www.dhs.gov/how-do-i/report-suspicious-activity

- ↑ https://www.osenlaw.com/content/how-terrorists-move-funds-through-global-financial-system

- ↑ https://www.usa.gov/complaints-lender

- ↑ http://corporate.moneygram.com/compliance/report-illegal-and-unusual-activity/ethics-violation-report

- ↑ http://corporate.moneygram.com/compliance/report-illegal-and-unusual-activity

- ↑ http://corporate.moneygram.com/compliance/report-illegal-and-unusual-activity/ethics-violation-report