This article was co-authored by Derick Vogel and by wikiHow staff writer, Janice Tieperman. Derick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

There are 12 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 25,017 times.

Credit card addiction is just as real and valid as any other addiction out there. Though not a drug, compulsive spending comes with the same highs and lows, making it difficult to break out of. You’re not alone, though—we’ve got your back. Keep reading for plenty of easy tips and suggestions that you can sprinkle into your routine to help conquer your spending habits. You’ve got this!

Steps

Cut up your credit cards.

-

Cutting up your cards forces you to pay for things more sustainably.[1] X Research source In the meantime, replace your credit cards with debit cards or cold, hard cash—this way, you can pay with money that you actually have.[2] X Research source

- Contact your bank and ask them to issue you a debit card if you don’t have one already.

- Keep in mind that chopping up a credit card won’t chop up your debt, too. You’ll still have to pay off your remaining balances and cancel the card.[3] X Research source

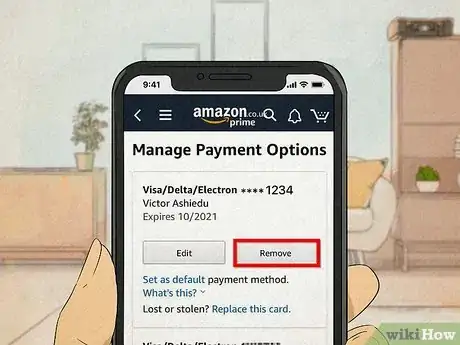

Remove any saved credit card info from online shopping sites.

-

Force yourself to type in your card info whenever you shop online. Keeping your card info saved on a shopping site makes impulse shopping all-too-easy. Instead, go into your account information and delete any saved credit cards from your profile.[4] X Research source

- Deleting your saved card info also makes your online shopping accounts safer. If your account were to get hacked, the would-be thief wouldn’t have instant access to your credit line.

Buy something practical the next time you get the urge to spend.

-

Toilet paper and window cleaner could be good options. Jot down a list of some useful, practical items that could make your day-to-day life a little easier, like paper towels, napkins, or toilet bowl cleaner. The next time you get the itch to go shopping, stock up on some of these useful items instead of buying something random.[5] X Research source Here are a few ideas:

- Toothpaste

- Dish soap

- Shower gel and shampoo

- Laundry detergent

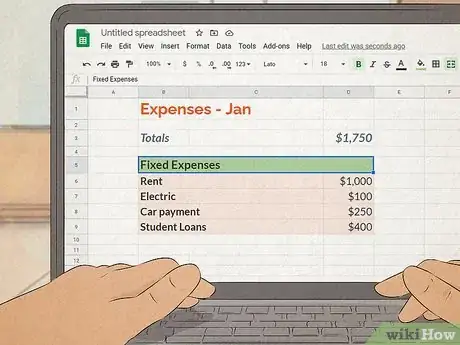

Develop a personal budget.

-

A budget helps you take control of your financial future. Jot down the goal of your budget, along with what you usually make and spend each month. Take a close look at all the purchases you’re making, and see what you can cut back. Seeing your finances and financial goals written out might make it easier to make a real change.[6] X Research source Plus, a budget can help you prioritize your bills over unnecessary purchases.[7] X Research source

- Some people like to write out their budget freehand, while others prefer to use a spreadsheet or free budget software, like Mint or Manilla.

- There are also plenty of apps to help you manage your budget, like Personal Capital, Mint, You Need a Budget, PocketGuard, and Goodbudget.[8] X Research source

Pay off any credit card debt with new money you earn.

-

It can be tempting to splurge the second your latest paycheck gets cleared. Still, it’s better to put that money toward your current debt. Log onto your credit card account and see what your current balance is—your paycheck can make a nice dent in this amount, even if you can’t pay off the total balance right away.[9] X Research source

- If you can’t decide what to do with your paycheck, transfer the money to your savings account instead.

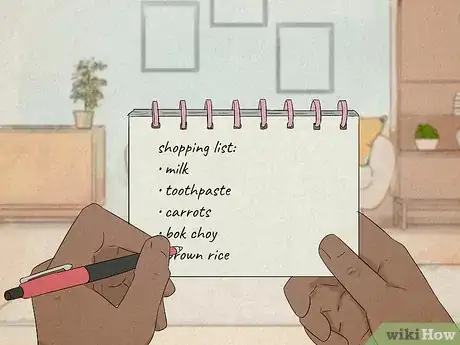

Write a shopping list before you go out.

-

Decide what you really need instead of randomly buying things. It can be super tempting to buy all sorts of items that you don’t really need, especially if you don’t have any specific shopping goals in mind. Before heading out, write down a specific list of what you need from the store. Limit yourself to whatever’s on that list, so you don’t rack up any extra credit card debt in the process.[10] X Research source

- Make a mental note if you want to buy something that isn’t on your shopping list. Then, add it to your shopping list for the next time you go out.

- Feel free to write a shopping list before going online shopping, too. Or, you might dedicate your online shopping trips to buying specific items.

Make a card with questions to ask yourself before you buy anything.

-

Take a look at this card before you start shopping. Stick it someplace where you'll be able to find and grab it easily, like a card slot in your wallet or right next to your computer monitor. When the time comes, read and reflect over each question to see if you can justify your potential purchase. Here are a few Qs you might include:[11] X Research source

- How am I feeling right now?

- Do I really need this item?

- What if I wait a few days or weeks before buying this?

- Will I have to pay for this on my credit card?

- Where will this item go in my home?

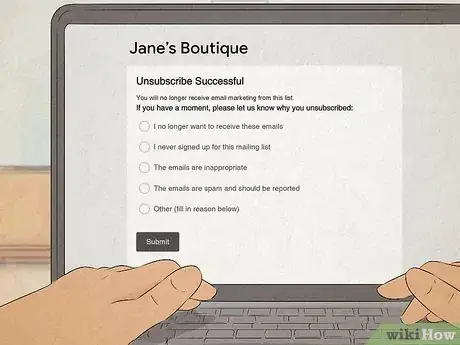

Unsubscribe from retail email chains.

-

Frequent email blasts can make it really tempting to splurge during a sale. Check your email inbox and see which brands contact you the most. Then, scroll to the very bottom of each message to find some sort of “unsubscribe” button.[12] X Research source

- If you don’t want to completely unsubscribe, some stores and brands might give you the option to customize your preferences so you don’t get emails as frequently.

Remove any shopping apps from your phone.

-

Out of sight, out of mind! Shopping apps make it all too easy to buy items with the tap of a finger. Cut out this extra temptation by completely deleting the apps from your phone.[13] X Research source

- Certain extensions and apps can completely block specific websites from your computer, tablet, and phone. BlockSite and Freedom work on both phones and computers, while extensions like Cold Turkey and LeechBlock NG work for just computers.[14] X Research source

Cut back on your social media time.

-

Targeted ads pop up on a lot of social media platforms. It’s not a coincidence when you see all these ads on Twitter, Facebook, and Instagram for products that you know and love. A lot of these ads aren’t legitimate, but that doesn’t make them any less tempting! Set a time limit for your social media use each day, or just delete the apps altogether.[15] X Research source

- Social media can also give you a big sense of FOMO (fear of missing out) when you see what other people are buying. Pulling the plug could be a refreshing change of pace!

Replace your urge to shop with a different hobby.

-

Sports, arts, and crafts are all viable options. A new hobby is a great, productive way to make the most of your free time without adding to your credit card balance.[16] X Research source Feel free to try out something you’ve always wanted to do, whether that’s scrapbooking, learning the trumpet, collecting stamps, or learning a new language. Here are a few more ideas:[17] X Research source

- Going for regular runs

- Learning new recipes

- Trying out community theatre

- Meditating

Get an accountability partner.

-

Ask a friend or loved one for “permission” before buying something new. Call or text that person whenever you feel tempted to splurge on an item. If they say “no” to your spending request, hold off on the purchase for the time being.[18] X Research source You might say:

- "Hey Deb! I really want to buy this new top, but I just wanted to check in with you first."

- "Hi Marty! I'm so tempted to splurge on a new laptop, but I promised that I'd check in with you before making any big purchases."

Stop by a local Debtors Anonymous meeting.

-

You’re absolutely not alone in what you’re going through. Countless people all over the world struggle with credit card addiction and the financial hurdles that come along with it. A Debtors Anonymous meeting can help you discuss and tackle your addiction in a safe, respectful environment full of people who understand what you’re going through.[19] X Research source

- Find your local Debtors Anonymous meeting here: https://debtorsanonymous.org/meetings/?tsml-day=any&first-call=1

Meet with a therapist if you can’t control your spending.

-

Credit card addiction is really tough to battle on your own. A therapist can help you figure what makes you so inclined to shop, and can help you address and tackle some difficult thought patterns related to your addiction.[20] X Research source

- Cognitive Behavioral Therapy (CBT) is a great avenue to pursue since it focuses on targeting and correcting thought patterns head-on.

You Might Also Like

How to Get Rid of a Porn Addiction

How to Get Rid of a Porn Addiction

How to Cut Down on Masturbating to Porn: 13 Techniques

How to Cut Down on Masturbating to Porn: 13 Techniques

Why Does My Boyfriend Watch Porn? 14 Things It Might Mean & How to Talk to Him About It

Why Does My Boyfriend Watch Porn? 14 Things It Might Mean & How to Talk to Him About It

How to Stop Watching Porn + Signs of Addiction & Negative Impacts

How to Stop Watching Porn + Signs of Addiction & Negative Impacts

How to Stop an Obsession with Someone or Something

How to Stop an Obsession with Someone or Something

How to Stop an Addiction: Your Guide to Recovery

How to Stop an Addiction: Your Guide to Recovery

References

- ↑ https://www.goodtherapy.org/learn-about-therapy/issues/compulsive-shopping/get-help

- ↑ https://www.forbes.com/sites/markkantrowitz/2020/11/06/how-to-get-your-spending-under-control/?sh=7425686823d4

- ↑ https://www.goodtherapy.org/learn-about-therapy/issues/compulsive-shopping/get-help

- ↑ https://www.forbes.com/sites/lizfrazierpeck/2019/10/24/three-reasons-you-should-never-save-payment-information-online/?sh=55088a6c9bb8

- ↑ https://www.mhanational.org/risky-business-compulsive-buying

- ↑ https://www.debt.org/advice/budget/

- ↑ https://www.mhanational.org/risky-business-compulsive-buying

- ↑ https://www.forbes.com/advisor/banking/best-budgeting-apps/

- ↑ https://www.mhanational.org/risky-business-compulsive-buying

- ↑ https://www.forbes.com/sites/markkantrowitz/2020/11/06/how-to-get-your-spending-under-control/?sh=7425686823d4

- ↑ https://money.com/shopping-addiction/

- ↑ https://www.forbes.com/sites/markkantrowitz/2020/11/06/how-to-get-your-spending-under-control/?sh=7425686823d4

- ↑ https://www.forbes.com/sites/markkantrowitz/2020/11/06/how-to-get-your-spending-under-control/?sh=7425686823d4

- ↑ https://www.wired.com/story/how-to-block-websites-chrome-firefox-ios-android/

- ↑ https://www.forbes.com/sites/markkantrowitz/2020/11/06/how-to-get-your-spending-under-control/?sh=7425686823d4

- ↑ https://www.goodtherapy.org/learn-about-therapy/issues/compulsive-shopping/get-help

- ↑ https://www.nytimes.com/guides/smarterliving/how-to-find-a-hobby

- ↑ https://www.forbes.com/sites/markkantrowitz/2020/11/06/how-to-get-your-spending-under-control/?sh=7425686823d4

- ↑ https://www.debt.org/faqs/debtors-anonymous/

- ↑ https://www.psychologytoday.com/us/blog/when-your-adult-child-breaks-your-heart/201612/compulsive-spending-what-you-need-know

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

About This Article