This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

There are 7 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article has 22 testimonials from our readers, earning it our reader-approved status.

This article has been viewed 5,196,776 times.

Writing checks is an easy and important skill every adult should know. To write a check, fill in the current date on the line in the upper right corner, the name of the recipient in the "Pay" field, the numerical amount next to the dollar sign ($), and the written form of the same amount on the line beneath; sign the check on the bottom right line and consider adding a "memo" about the check's purpose on the lower left line. The more often you write checks, the more natural the process will become.

Steps

Annotated Check

Writing a Check

-

1Write the date on the line in the upper right-hand corner. There will be a blank space next to or above the word "Date." Remember that a check is a legal document, and the date written here should always be the day that you sign the bottom of the check.[1]

-

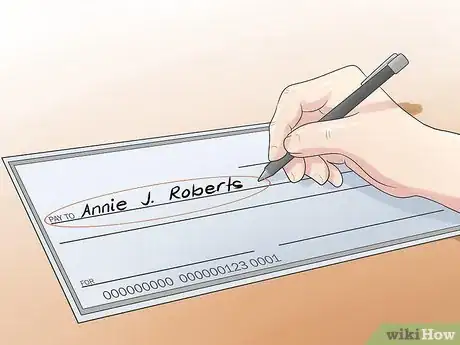

2Write the name of the recipient. Write the name of the person or company you're sending the check to next to the line that says "Pay to the Order of." If it's a company and you're not sure exactly what it's called, make sure you get that information right before you write the check. You can also just pay the check to "Cash," but be careful, because that means that anyone can cash it.[2]

- If it's to an individual, include both their first and last names. If they are a 'Jr.' or a 'Sr.' you should include this as well.

- If the check is going to an organization, write out its full name. Do not use acronyms unless explicitly given permission.

- A check is a legal document because it is signed and dated, and the recipient needs to sign it also. The bank is a legal institution that can deny the check being cashed/deposited with missing information.

Advertisement -

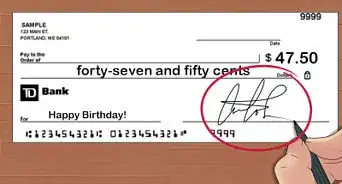

3Write the amount of the check to the right of the dollar sign. Write the exact amount, using dollars and cents. If the check is for twenty dollars, write "20.00."

-

4Write the monetary amount of the check in word form below the "Pay to the Order of" line. Make sure you also express the number of cents if there are cents, or write "even" at the end of the amount so that another person doesn't add more money to the amount. If you've written a check for $20.00, write either "Twenty dollars and 0/100 cents," "Twenty dollars even," or just "Twenty" with a line running all the way from the right of the word to the end of the line.[3]

-

5Sign the check on the line in the bottom right corner. Your check will be invalid if it is not personally signed.[4]

-

6Fill out the memo section on the bottom left of the check. Though this part of the check is optional, it can be helpful to write a note to yourself or the recipient to remember what the check is for. You can write "For May rent" if you're sending a rent check. Also, many companies or landlords require that you provide some other information in the memo section; some companies require you to write your ID number in the "Memo" section, and if you're writing a rent check for your apartment, you should write the apartment # right in the memo section.[5]

Expert Q&A

-

QuestionCan I write myself a check and get it cashed?

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Financial Accountant Technically, you're not writing a check to yourself—your company is writing a check to a person. For example, let's say that someone died and you're the trustee of their trust. At some point, you're writing checks for reimbursement as you drive back and forth to the funeral home and the cemetery. The name on the check would be the trust account, but you'd put in the memo that you're writing a check for yourself.

Technically, you're not writing a check to yourself—your company is writing a check to a person. For example, let's say that someone died and you're the trustee of their trust. At some point, you're writing checks for reimbursement as you drive back and forth to the funeral home and the cemetery. The name on the check would be the trust account, but you'd put in the memo that you're writing a check for yourself. -

QuestionWhat is the purpose of post-dating a check?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor Legally, post-dating a check has no meaning. Once a check is signed, it becomes legal tender regardless of the date of the check. Rules regarding post-dating vary from state to state. Banks are generally not liable for cashing a post-dated check unless certain rules about notice are strictly followed. As a consequence, the use of post-dated checks is rarely justified.

Legally, post-dating a check has no meaning. Once a check is signed, it becomes legal tender regardless of the date of the check. Rules regarding post-dating vary from state to state. Banks are generally not liable for cashing a post-dated check unless certain rules about notice are strictly followed. As a consequence, the use of post-dated checks is rarely justified. -

QuestionWhy is the account number pre-printed on the face of the check?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

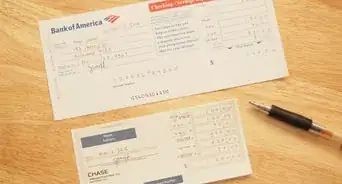

Business Advisor Checks typically have a routing number identifying the financial institution where funds are held and an account number to identify the customer's account at that institution to ensure proper transfers of money. Many checks also include a third number identifying the check sequence for the account holder's convenience.

Checks typically have a routing number identifying the financial institution where funds are held and an account number to identify the customer's account at that institution to ensure proper transfers of money. Many checks also include a third number identifying the check sequence for the account holder's convenience.

Warnings

- Make sure your check is written out correctly with the correct spelling of the name and the correct amount of money due to that person.⧼thumbs_response⧽

- When tearing the check from your checkbook, be sure to tear as cleanly as possible. The printed numbers along the bottom of the check, called the MICR line, are necessary for cashing or depositing the check; so is the check number, usually located in the top right near the date. If any of these numbers are partially torn off, the check will be rendered invalid.⧼thumbs_response⧽

- Remember that post-dated checks can be deposited immediately. The date is used to determine when a check becomes stale and will be refused by the bank (typically 7 years after the date unless otherwise specified), not the earliest date that the check can be cashed. A lot of people have been burned by unscrupulous people promising to hold onto checks until the specified date(s).⧼thumbs_response⧽

Things You'll Need

- A bank checking account

- A book of checks

- A pen

References

- ↑ http://www.themint.org/teens/writing-a-check.html

- ↑ https://www.immihelp.com/newcomer/writing-a-check-tips.html

- ↑ https://comptroller.texas.gov/taxes/file-pay/check.php

- ↑ https://www.huntington.com/Personal/checking/checks/how-to-write-a-check

- ↑ https://www.investopedia.com/university/banking/banking3.asp

- ↑ http://www.lawfirms.com/resources/criminal-defense/criminal-offense/check-fraud.htm

- ↑ http://www.legalmatch.com/law-library/article/postdated-checks.html

About This Article

To write a check, write the date on the line in the upper right hand corner and write the recipient’s name on the “Pay to the Order of” line. Put the amount next to the dollar sign, making sure to write it in both dollars and cents. Write that same amount in word form on the line below. Finally, sign the check in the bottom right hand corner to make it valid. To learn more, such as what to include on the Memo line, keep reading!