I would like to calculate RSI 14 in line with the tradingview chart.

According to there wiki this should be the solution: https://www.tradingview.com/wiki/Talk:Relative_Strength_Index_(RSI)

I implemented this is in a object called RSI: Calling within object RSI:

self.df['rsi1'] = self.calculate_RSI_method_1(self.df, period=self.period)

Implementation of the code the calculation:

def calculate_RSI_method_1(self, ohlc: pd.DataFrame, period: int = 14) -> pd.Series:

delta = ohlc["close"].diff()

ohlc['up'] = delta.copy()

ohlc['down'] = delta.copy()

ohlc['up'] = pd.to_numeric(ohlc['up'])

ohlc['down'] = pd.to_numeric(ohlc['down'])

ohlc['up'][ohlc['up'] < 0] = 0

ohlc['down'][ohlc['down'] > 0] = 0

# This one below is not correct, but why?

ohlc['_gain'] = ohlc['up'].ewm(com=(period - 1), min_periods=period).mean()

ohlc['_loss'] = ohlc['down'].abs().ewm(com=(period - 1), min_periods=period).mean()

ohlc['RS`'] = ohlc['_gain']/ohlc['_loss']

ohlc['rsi'] = pd.Series(100 - (100 / (1 + ohlc['RS`'])))

self.currentvalue = round(self.df['rsi'].iloc[-1], 8)

print (self.currentvalue)

self.exportspreadsheetfordebugging(ohlc, 'calculate_RSI_method_1', self.symbol)

I tested several other solution like e.g but non return a good value:

https://github.com/peerchemist/finta https://gist.github.com/jmoz/1f93b264650376131ed65875782df386

Therefore I created a unittest based on : https://school.stockcharts.com/doku.php?id=technical_indicators:relative_strength_index_rsi

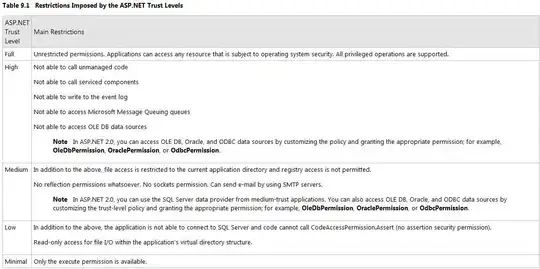

I created an input file: (See excel image below) and a output file: (See excel image below)

Running the unittest (unittest code not included here) should result in but is only checking the last value.

if result == 37.77295211:

log.info("Unit test 001 - PASSED")

return True

else:

log.error("Unit test 001 - NOT PASSED")

return False

But again I cannot pass the test. I checked all values by help with excel.

So now i'm a little bit lost.

If I'm following this question: Calculate RSI indicator from pandas DataFrame? But this will not give any value in the gain.

- a) How should the calculation be in order to align the unittest?

- b) How should the calculation be in order to align with tradingview?