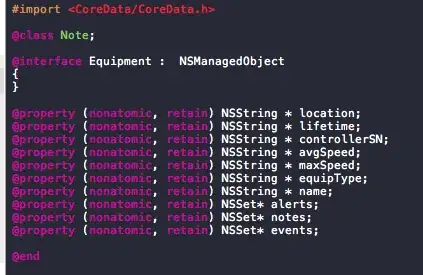

Is it possible to add texts like "BUY" and "SELL" near the green and red arrows in chart.Posn() function. (not with manual trial of coordinates, I need an automatic solution) I have changed the source code of function a bit and increased the size of arrows:

If a minimum reproducible example is needed, I can provide but this is a basic question for graphical parameters of R.

Your help is appreciated.

Edit for a minimum reproducible example:

library(quantstrat)

start_date <- as.Date("2018-02-02")

end_date <- as.Date("2018-09-24")

init_date <- as.Date("2018-01-01")

init_equity <- "50000"

adjustment <- TRUE

symbol <- "AAPL"

getSymbols(symbol, src = "yahoo",

from = start_date, to=end_date,

adjust = adjustment)

portfolio.st <- "basic_port"

account.st <- "basic_account"

strategy.st <- "basic_strategy"

rm.strat(portfolio.st)

rm.strat(account.st)

stock(symbol, currency = currency("USD"), multiplier = 1)

initPortf(name = portfolio.st, symbols = symbol, initDate =init_date)

initAcct(name = account.st, portfolios = portfolio.st,

initDate = init_date, initEq =init_equity)

initOrders(portfolio.st, symbol, init_date)

strategy(strategy.st, store = TRUE)

add.indicator(strategy = strategy.st, name = "SMA",

arguments = list(x = quote(Cl(mktdata)), n=10),

label ="nFast")

add.indicator(strategy = strategy.st, name = "SMA",

arguments = list(x = quote(Cl(mktdata)), n=30),

label = "nSlow")

add.signal(strategy = strategy.st,

name= "sigCrossover",

arguments = list(columns = c("nFast", "nSlow"),

relationship = "gte"),

label = "longenter")

add.signal(strategy = strategy.st,

name= "sigCrossover",

arguments = list(columns = c("nFast",

"nSlow"),

relationship = "lt"),

label = "longexit")

#Add rules for entering positions

#enter long position

add.rule(strategy.st,

name = "ruleSignal",

arguments = list(sigcol = "longenter",

sigval = TRUE,

orderqty = 100,

ordertype = "market",

orderside = "long",

orderset= "ocolong",

prefer = "Close",

TxnFees = -.8,

replace = FALSE),

type = "enter",

label = "EnterLong")

#stoploss long

add.rule(strategy = strategy.st,

name = "ruleSignal",

arguments = list(sigcol = "longenter",

sigval = TRUE,

TxnFees=-.8,

replace = FALSE,

orderside = "long",

ordertype = "stoplimit",

orderqty = "all",

tmult = TRUE,

prefer = "Close",

order.price=quote(as.numeric(mktdata$AAPL.Low[timestamp])),

orderset="ocolong"),

type = "chain", parent = "EnterLong",

path.dep=TRUE,

label = "stop_loss_long",

enabled=TRUE)

#Apply strategy

applyStrategy(strategy.st, portfolios = portfolio.st,debug = TRUE)

updatePortf(portfolio.st)

updateAcct(account.st)

updateEndEq(account.st)

st<- "2018-05-01 00:00:00"

fn<-"2018-06-20 00:00:00"

chart.Posn(portfolio.st, Symbol = symbol, Dates = paste(st, fn, sep="::"))