This article was co-authored by Joanne Gruber. Joanne Gruber is the owner of The Closet Stylist, a personal style service combining wardrobe editing with organization. She has worked in the fashion and style industries for over 10 years.

There are 9 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status.

This article has been viewed 70,631 times.

It can be very tempting to buy items that you do not actually need. For some people, these urges become a compulsion that is very difficult to resist. To gain control once again, it is best to only carry cash and stop using all credit cards. Spend your free time outdoors and learning new things instead of shopping. Reaching out to your friends, family, and a therapist can offer you the additional support that you'll need.

Steps

Changing How Your Purchase Items

-

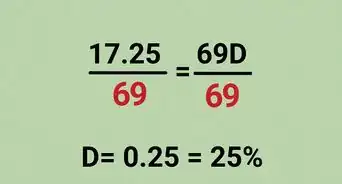

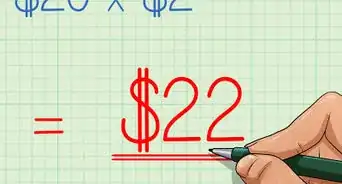

1Pay with cash only. Start to carry cash in a variety of denominations with you when out shopping. Buying everything with cash will make the transactions seem more real. You'll actually have to count out the money that you've earned instead of simply handing over a piece of plastic. If you give yourself a certain amount of cash to spend each week, you can also start to budget.[1]

- Studies have shown that people will spend twice as much on the same item when they pay with a credit card instead of cash.[2]

- If you are trying to avoid spending any money at all, you can leave your entire wallet at home as well.

-

2Cut up all of your charge cards. Make all of your cards inaccessible by cutting them in half with scissors. Make sure to keep one with a higher limit intact, just in case you have an emergency. You might want to give this card to a trusted friend or family member for safekeeping. Also, clear out all saved credit card information from your computer to keep you from making online purchases.

- Cutting the cards up is enough, you do not need to formally close out the accounts. Closing a charge account can have a negative impact on your credit score.[3]

- It is okay to leave cards active online in order to pay recurring bills, such as utilities.

Advertisement -

3Wait thirty minutes before making a purchase. If you see something at the store that you must have, then look at your watch and give yourself a half-hour to think about buying it. Walk around in other sections of the store or leave the place entirely and decide to come back if necessary.[4]

-

4Make a list before shopping. Before you head out to the grocery or department store, sit down with pen and paper (or your phone) and make a detailed shopping list. It should contain all of the items that you plan to purchase. As you pick up each item, mark if off the list.[5]

-

5Block shopping websites on your computer. You can go to your browser settings and check down any particular shopping sites as blocked. This will make it more difficult to access them if the urge to shop overtakes you. You can also purchase a program, such as Covenant Eyes, which will monitor and block commercial sites from your personal electronic devices.[6]

- Every week or so go through and clear out your cookies and cache as well. This will make it more difficult for companies to send ads to you via your computer.

-

6Block all promo or coupon emails or mailers. Go through your emails and click “unsubscribe” to any sent by companies advertising products. Look through your paper mail and call or email those companies who send you mailers or fliers for products. Keep doing this until you no longer receive these mailings.[7]

-

7Remove all shopping apps from your mobile devices. Select and delete or disable all commercial or shopping apps from your phone or tablet. You should even remove those that are linked to reward programs. Also, disable any “one-click” purchasing preferences that are activated on sites or apps, such as Amazon.[8]

Documenting Your Spending

-

1Create a spreadsheet showing your expenses. Enter each of your monthly expenses into an Excel spreadsheet. Make sure to include the exact amounts of each bill as well as the due dates. Then, write down the deposits that you'll receive as well. Whenever you consider making a purchase, remember your existing account balance.[9]

- You can also use a phone app or computer program to track your spending and create a budget.

-

2Set an emergency fund goal. For peace of mind, it is a good idea to have six months of basic expenses saved up. Come up with this amount, write it down on a piece of paper, and post it somewhere visible in your home, such as on the refrigerator. Before you go out shopping, look at this number and recall your overall goal.[10]

- If you already have an emergency fund saved up, then you can find another goal, such as saving for a major vacation or buying a home.

-

3Keep a journal documenting your shopping urges. Understanding what triggers your shopping splurges will help you to regulate them in the future. Write down a quick note whenever you feel the desire to spend extra money. Note your feelings at the time. Do you feel bored, depressed, angry? If so, these may be your emotional shopping triggers.[11]

- In the future, when a particular emotion hits you, be prepared for a shopping urge to follow and you will be less likely to give into it.

Channeling Your Shopping Urges Elsewhere

-

1Talk yourself out of spending money. Whenever you feel the desire to buy something, tell yourself, “I can't afford this right now.” Or, “I have other things that I need more.” Develop a series of phrases that will work to get your mind off making a purchase. Repeat these statements until you lose interest in the item.

- Keep the self-talk positive by telling yourself, “Good job,” once you've avoided making a purchase.

EXPERT TIPJoanne Gruber is the owner of The Closet Stylist, a personal style service combining wardrobe editing with organization. She has worked in the fashion and style industries for over 10 years.Professional Stylist

Joanne Gruber

Joanne Gruber

Professional StylistTry rearranging what you already have. Stylist and wardrobe expert Joanne Gruber says: "You don't need to spend money to stay fashionable or on-trend. If you're wearing one really awesome statement piece, the rest of your outfit can just be basics.

-

2Focus on a new activity. Spend your energies learning something new, such as painting or cooking. These pursuits will take up time and are a much better use of your resources than buying unneeded items. Keep finding new things to learn, so that you don't get bored over time.[12]

-

3Go for a walk instead. Spend the time that you would've spent shopping on physical activities instead. Take an exercise class or go for a nice walk outside. See if you enjoy running or another sport. You will get an adrenaline rush from being active without the added burdens to your wallet.

-

4Question why you feel the need to shop. Look deep into yourself and try to create a self-portrait of what drives your shopping urges. Perhaps you only shop as a pick me up at the end of a long day. Or, maybe you shop to relieve fear or boredom. Keep asking yourself, “why?,” until you start to find some answers.

- Redirect these urges by targeting the core problem. If you shop because you are bored, you will need to keep yourself busy, perhaps by learning something new. If you shop because you are depressed, talking with a counselor could prove helpful.

Reaching Out to Others for Help

-

1Call a friend for support. Find a close friend or family member who you trust, and who you can call whenever the urge to shop strikes you. Tell them in advance that you are trying to stop shopping and ask for their assistance. Make sure that you choose someone who is able to talk you down from your shopping impulses.

- When asking for help, you might say, “I've been struggling with buying things I really don't need. Do you mind if I call you when I get a shopping urge? Are you willing to help talk me out of it?”

-

2Take someone else shopping with you. Pick out a shopping buddy and plan monthly shopping excursions that you can look forward to. Make sure that you choose someone who is careful with their spending and who operates on a defined budget. Then, select an exact dollar amount that you are capable of spending on your trip and let your friend know that amount.

-

3Talk with a financial counselor. You can find a financial advisor near you by entering your location and “financial advisor” into a search engine. Look for someone who has good online reviews. You also want a person who does not cost too much per visit. Then, sit down and talk with them about your spending habits and the changes that you can make.[13]

- If you cannot afford counseling, talk to the advisor about any free services that they offer. They may provide free financial sessions or group meetings.

-

4Seek professional therapy. Locate a therapist near you by searching “shopping addiction therapist” and your location in a search engine. Then, choose a therapist that fits your budget and schedule. In therapy, you may work on changing your shopping energies in new directions. You may also learn how to be more mindful of those purchases that you do make.[14]

- Your therapist, working with your doctor, may also suggest that you take a medication to counter your shopping impulses. Anti-depressants are sometimes prescribed to compulsive shoppers.[15]

-

5Attend a support group. Look for a group in your area that meets to discuss shopping and other addictions. Debtors Anonymous has chapters in the United States and similar organizations exist around the world. Make sure to attend regularly and speak honestly to get the most out of your sessions.[16]

Community Q&A

-

QuestionHow can I find out if there is a credit card/shopping addiction program available in my area?

Robin SagerCommunity AnswerThe best way to find out if a program exists near to you is to contact a local government entity, such as a social services department. You can also reach out to a local therapist and ask if they are aware of any groups that meet in your location, or you could search online for programs in your area.

Robin SagerCommunity AnswerThe best way to find out if a program exists near to you is to contact a local government entity, such as a social services department. You can also reach out to a local therapist and ask if they are aware of any groups that meet in your location, or you could search online for programs in your area.

Warnings

- Be aware that not seeking out help for a shopping addiction can lead to serious financial problems.⧼thumbs_response⧽

References

- ↑ http://new.www.huffingtonpost.com/2012/09/14/shopaholic-7-signs-addicted-to-shopping_n_1883751.html

- ↑ http://www.thesimpledollar.com/treating-credit-card-addiction/

- ↑ http://www.thesimpledollar.com/treating-credit-card-addiction/

- ↑ http://www.bankrate.com/finance/personal-finance/5-steps-to-stop-compulsive-spending-1.aspx#ixzz4YinGUht3

- ↑ http://new.www.huffingtonpost.com/2012/09/14/shopaholic-7-signs-addicted-to-shopping_n_1883751.html

- ↑ http://money.usnews.com/money/blogs/my-money/2014/12/02/5-ways-to-combat-an-online-shopping-addiction

- ↑ http://money.usnews.com/money/blogs/my-money/2014/12/02/5-ways-to-combat-an-online-shopping-addiction

- ↑ http://money.usnews.com/money/blogs/my-money/2014/12/02/5-ways-to-combat-an-online-shopping-addiction

- ↑ http://www.bankrate.com/finance/personal-finance/5-steps-to-stop-compulsive-spending-1.aspx#ixzz4Yin0cEm1

- ↑ http://www.thesimpledollar.com/treating-credit-card-addiction/

- ↑ http://www.cbsnews.com/news/5-ways-to-beat-your-shopping-addiction/

- ↑ http://new.www.huffingtonpost.com/2012/09/14/shopaholic-7-signs-addicted-to-shopping_n_1883751.html

- ↑ https://www.addictions.com/shopping/

- ↑ http://www.goodtherapy.org/learn-about-therapy/issues/compulsive-shopping

- ↑ http://news.bbc.co.uk/2/hi/health/3077569.stm

- ↑ http://www.cbsnews.com/news/5-ways-to-beat-your-shopping-addiction/

- ↑ http://www.thesimpledollar.com/treating-credit-card-addiction/

Medical Disclaimer

The content of this article is not intended to be a substitute for professional medical advice, examination, diagnosis, or treatment. You should always contact your doctor or other qualified healthcare professional before starting, changing, or stopping any kind of health treatment.

Read More...